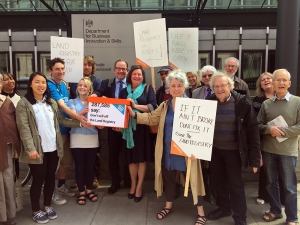

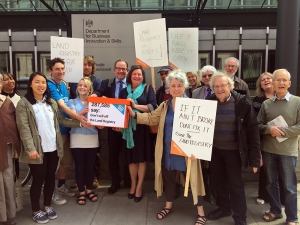

Joy travelled to London last Wednesday with James Ferguson from Xpress Legal Services to meet with MPs to put foward the reasons why the Land Registry should not be privatised, before a debate in Parliament took place on Thursday. The debate was led by backbench MP David Lammy after more than 60 MPs signed a letter demanding the plans to privatise the Land Registry be called off.

Joy Bassett and James Ferguson have been leading the campaign from down here in Cornwall since the government proposed the plans in 2014.

Joy was instrumental in bringing the other stakeholders together believing that it is better to have a united front. Each stakeholder group had its own reasons for wanting the Land Registry to stay in the public sector, but they all share a common concern that the role and function of the Land Regsitry in registering title and guaranteeing land rights must remain impartial and independent from any commercial interests. Joy invited the stakeholders to come together to take part in what became the campaign video to help raise awareness.

We didn’t feel enough had been done by the Department of Business, Innovation & Skills to bring the sell-off of this significant asset to the public’s attention. Until we brought it to people’s attention, they knew nothing about the plans, but when they did find out, they are outraged!

James started the first 38Degrees Petition which was handed in to the Department of Business, Innovation & Skills (BIS) in May 2014 with more than 104,000 signatures. He then set up a second petition in March 2016 following the announcement that BIS had launched a new public consultation on privatising the Land Registry. This time, the consultation question wasn’t ‘should the Land Registry be privatised’ but, ‘how should it be done’!

Hand -In of 38 Degrees Petition 26th May 2016.

The response from the public was overwhelming! James and Joy travelled up to London to join the rest of the campaign team in on 26th May to deliver the second petition to Business Secretary Sajid Javid, this time with a whooping 287,585 signatories!

The response from the public has been one of outrage.

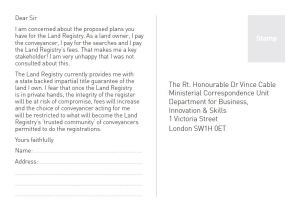

On the train up to London on the day of the Hand-In, Joy took the opportunity to give leaflets to passengers with postcards for them to sign addressed to the Business Secretary expressing their concern and asking him to scrap the plans. The usual response was one of shock! The majority of people she spoke to had not heard about the plans and they were angry and concerned enough to sign the postcard straight away and hand it back to her to deliver to the Business Secretary’s office.

Postcards to Business Secretary Javid Javid

Trish Murrary from 38 Degrees invited signatories of the petition to respond to the consultation via an easy to use link. Most public consultations might attract 200 -300 submissions, this one had already received 450! But thanks to Trish, in the 24 hours before the consultation closed, more than 28,000 people submitted a response and a further 65,000 people signed the petition!

The petition which is still open, now stands at over 303,000 signatures. Contrary to the government’s view as stated in the 2016 consultation document, that there is no compelling case for keeping the Land Registry in public ownership. The results of the first consultation in 2014 showed only 5% of the responses agreed, while 95% disagreed with the plans.

Stakeholders give their reasons why the Land Registry shouldn’t be privatised:

The PCS Union: Michael Kavanagh, the President of the Land Registry branch of the PCS Union says, “Land registration must remain an impartial and trusted role of the state, free from commercial exploitation and conflict of interest. Privatisation would inevitably lead to increased fees for the public if the motive shifted from the public services to profit.

Our dedicated members spend a large amount of time rectifying historical errors, investigating disputes and preventing property fraud. This work would undoubtedly suffer if privatisation were to occur.”

Local Authorities: The proposals for the Land Registry to take over parts of a Local Authority search are causing concern for Local Land Charges Officers and the private search agents. The takeover of the Local Land Charges function by Land Registry would lead to a more fragmented, more costly and less reliable service than that which already exists and would result in a poorer service for the property-buying public and the businesses that assist them.

The Search Agents: IPSA, the trade body for Independent Search Agents are also concerned that by the Land Registry providing the searches, there will be no competition and the cost of searches to the home buyer will rise.

The Lawyers: Many conveyancing solicitors have raised concerns about the proposals on behalf of their clients. President of the Law Society Jonathan Smithers said, “Privatisation of the Land Registry would mark a significant change to a vital piece of our nation’s infrastructure. The ability of any owner or company to have certainty about the ownership and status of land is central to the way our economy functions”.

Homeowners: Denise Watts from Lostwithiel in Cornwall says, “It’s not theirs to sell! It’s all about security and protection of our data. Selling the Land Registry is like selling off another piece of family silver, except the information the Land Registry hold about us, our title deeds, our mortgage deeds, makes it a piece of silver with our names engraved on it!”

Many others have also voiced their concerns. The British Property Federation (BPF), the competition watchdog (CMA), Open Data Institute (ODI) and the Council of Mortgage Lenders (CML) the FDA union, they have all voiced a number of concerns, some of which are:

- Land Registry data becomes a profit making product rather than being easily accessible to the public

- Conflict of interest

- Anti-competitive

- As a private company they would be exempt from the Freedom of Information Act

- Corruption

- Privatisation would cost the taxpayer money – need for regulation

- High Street law firms could once again be excluded from the property market

James Ferguson is the Director of Xpress Legal Services, a property search company that provides conveyancers with the necessary searches needed when buying a property. He is concerned that a privatised Land Registry would become a one stop shop, restricting competition by having the monopoly on all property related data,

Our firm is concerned that should the plans go ahead, the future of high street law firms are further under threat. Lots of SME law firms closed after the lenders removed scores of firms from their conveyancing panels during 2012 – 2014. That has a knock on effect on the consumer, because when a firm closes down, it’s not just the local conveyancing that disappears, but access to all the other areas of law a firm could offer. With access to justice already an issue, people struggle these days to find affordable legal services local to where they live.

Former Chief Land Registrar John Manthorpe says “The Land Registry is self-funding, operating at no cost to the public purse. It has an excellent record of holding and reducing its costs and its fees to customers. It pays an annual dividend to the Exchequer. It is highly regarded by those who depend on it as a provider of trusted, prompt services. It is difficult to see how security of tenure and a functioning property and mortgage market in this country could be sustained without Her Majesty’s Land Registry, as a public department of government, continuing to provide the impartial and quasi-judicial title guarantees on which the workings of the economy rely.”

He has repeatedly warned “this is not an activity that any responsible Government can pass to the private sector.” He is concerned that the authors of the consultation document have not understood the adjudicatory nature of the Registry’s work on registering title, guaranteeing land rights and guaranteeing too pre-contract and pre-completion search results. Such results, which are backed by indemnity, make possible the millions of transactions in land rights on which the property market depends.

The Times reported on the 26th May that all bidders in the Land Registry have links to tax havens. MP David Lammy points out, “This privatisation would be a huge step backwards in tackling the large-scale institutional corruption and tax avoidance brought to light by the Panama Papers.”

Short-term economic plan.

With so many valid reasons as to why the Land Registry should not be privatised, the one main reason driving the plan ahead is because the Chancellor so desperately needs the money to reduce the deficit. PCS General Secretary, Mark Serwotka, describes the sell off as being “deeply dangerous” and says that the proposal is based on a political choice, not economic necessity. It is being driven by the Treasury’s demand for cuts and short-term returns and is neither required nor being requested by anyone who works in the industry.

‘We Own It‘, a campaign group for keeping public services public, run for people not profit, have published a report which states, “Selling off the UK public assets such as the Land Registry will leave the government’s finances worse off in the long-term as cash from the sale is outstripped by future profits”.

Campaign timeline of events so far:

2nd July 2014 38 Degrees petition with more than 104,000 signatures, started by James Ferguson on behalf of the campaign, was handed into the Department for Business Innovation and Skills.

11th July 2014 Vince Cable, the then Business Secretary announced the plans to privatise the Land Registry had been abandoned.

25th Nov 2015 A second 38 Degrees petition was launched after George Osborne asked investment bank Rothschild to report on the options for selling the Land Registry.

26th May 2016 A second Petition handed into Department of Business Innovation and Skills with more than 287,000 signatures saying NO to the plans to privatise.

26th May 2016 The Times reported that every investment firm interested in bidding for the Land Registry had links to tax havens.

26th May 2016 Public Consultation closed with more than 28,000 submissions.

14th June 2016 More than 60 MPs signed a letter written by MP David Lammy calling for a debate.

30th June 2016 A debate led by MP David Lammy in the House of Commons.

1st July 2016 Following the debate, the headlines read; “Business minister George Freeman suggests proposal is now a matter for new administration to resolve, with MPs strongly against privatisation”

The campaign goes on until the plans are scrapped once and for all.

Letters to MPs are still being written.

MPs and the media have asked Business Secretary Sajid Javid on numerous occasions for a response. He has consistently replied with “No decision will be made until after the consultations have been reviewed.”

We have two questions for Sajid Javid:

- How much opposition will it take for the plans to be scrapped once and for all?

- What did the Rothschild’s report to HM Treasury say?